El próximo 28 de octubre se desarrollará el primer desayuno informativo sobre gestión económica y turística – Popular TV Melilla

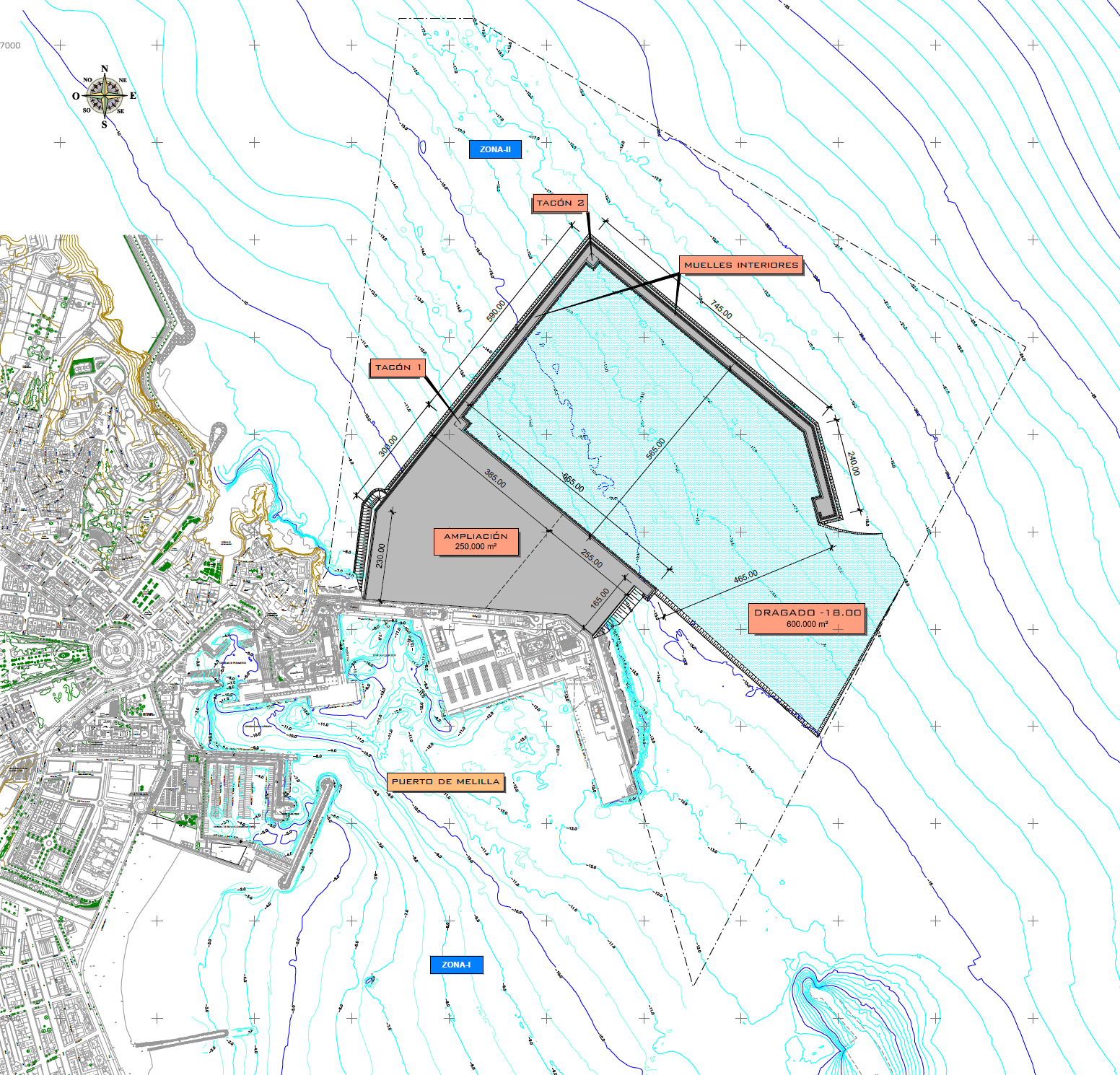

El Puerto de Melilla recibirá 2.133.000€ por su extrapeninsularidad y por ser ciudad fronteriza con Marruecos | El Estrecho Digital

Blog SALAMA para agencias de viajes | El blog del Ciclo Superior de Agencias de Viajes y Gestión de Eventos (Hostelería y Turismo). IES "Juan Antonio Fernández Pérez"